Term life insurance is a simple and affordable way to protect your family’s future. It offers coverage for a set time, like 10, 20, or 30 years. If you pass away during this time, your loved ones get a death benefit. It’s different from permanent life insurance because it doesn’t build cash value. This makes it a cost-effective choice for families looking to secure their finances.

Term life insurance is known for its simplicity, low cost, and flexible options. This means you can get a higher death benefit without spending too much. It’s a smart choice to protect your family’s well-being.

Key Takeaways

- Term life insurance provides coverage for a set period, typically 10, 20, or 30 years, offering a death benefit to your loved ones.

- Premiums for term life insurance are usually lower than those for permanent life insurance, making it a more affordable option for families.

- Term life insurance policies can be tailored to meet your specific needs, with options like level term, decreasing term, and convertible term.

- The DIME formula (Debt, Income, Mortgage, Education) can help you determine the appropriate coverage amount for your family.

- Selecting the right term life insurance policy involves evaluating your coverage needs, budget, and policy features to ensure your family’s financial security.

- https://balamga.com/why-you-should-never-skip-best-travel-rewards-credit-cards/

What is Term Life Insurance?

Term life insurance is a simple and affordable way to protect your family’s financial future. It offers coverage for a set period, like 10, 20, or 30 years. If you pass away during this time, your loved ones get a death benefit to help them out.

Term life insurance is different from permanent life insurance because it doesn’t build cash value. You pay a premium to keep the coverage active. This makes it a good choice for families who want protection without the extra complexity of cash value.

| Term Life Insurance | Permanent Life Insurance |

|---|---|

| Provides coverage for a specific term, typically 10-30 years | Provides lifelong coverage, with no term limit |

| Premiums are generally lower than permanent life insurance | Premiums are typically higher than term life insurance |

| Does not accumulate cash value | Accumulates cash value that can be accessed during the policyholder’s lifetime |

| Renewable at the end of the term, but premiums increase with age | Premiums remain level throughout the policyholder’s lifetime |

Term life insurance is great for starting a family, buying a home, or protecting your loved ones. It offers the coverage you need at a price you can handle. Knowing how term life insurance works helps you make a smart choice for your family’s financial security.

Benefits of Term Life Insurance for Families

Term life insurance is great for families wanting financial security. It offers a death benefit that pays out if you die during the policy term. This money can help pay off debts like a mortgage and cover daily costs like raising kids and education funding.

It also helps replace your income, keeping your family’s lifestyle the same even without you. With its affordable prices and flexible plans, term life insurance is a wise choice for families.

- Affordable death benefit coverage

- Replacement of lost income for your family

- Protection against debt and mortgage payments

- Ability to fund your children’s education

- Provides a sense of financial security for your loved ones

“Term life insurance is an essential safeguard for modern families, offering the peace of mind that comes with knowing your loved ones will be financially secure, even in the unexpected event of your passing.”

Getting term life insurance means your family’s financial well-being is protected. It’s a smart, affordable way to ensure your family’s future is secure.

Types of Term Life Insurance Policies

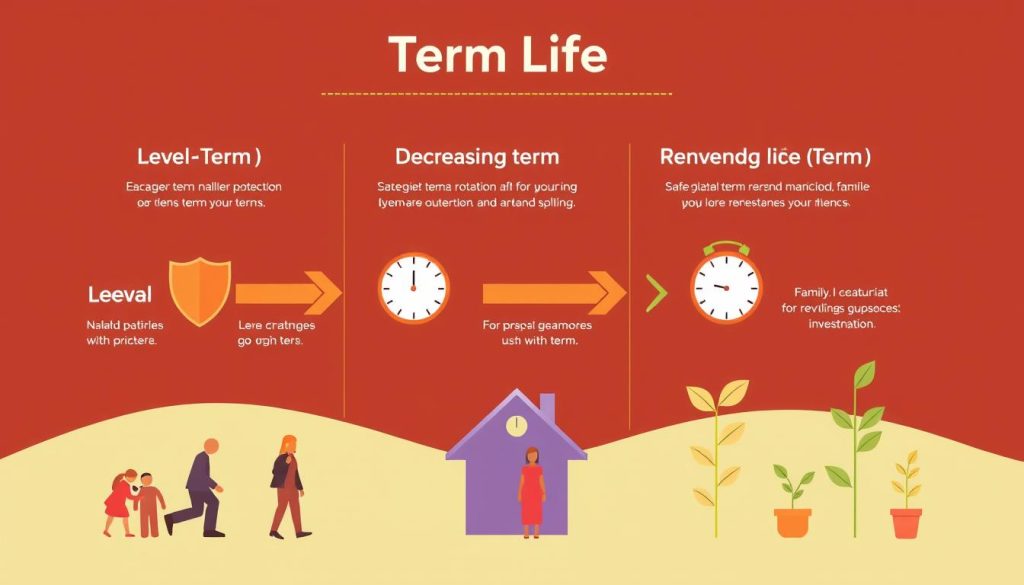

Term life insurance is a smart way to protect your family’s future. There are many types of term life insurance, each meeting different needs. Knowing what each policy offers can help you choose the right one for your family.

Level Term Life Insurance

Level term life insurance keeps the death benefit and premiums the same for the policy term. It’s a favorite for keeping your family’s finances safe. It’s great for long-term plans like mortgages or college tuition because it’s so predictable.

Decreasing Term Life Insurance

Decreasing term life insurance has a death benefit that goes down over time, but premiums stay the same. It’s perfect for covering debts that get smaller, like a mortgage. This way, your coverage matches your decreasing liability.

Convertible Term Life Insurance

Convertible term life insurance lets you switch to a permanent policy like whole or universal life without medical exams. This flexibility is key as your life and needs change. It gives you the chance to move to a more lasting policy.

Looking into these term life insurance types can help you find the best fit for your family. It’s all about meeting your family’s specific needs and financial goals.

Determining Your Term Life Insurance Needs

Securing your loved ones’ financial future is a top priority. Finding the right term life insurance coverage is key. The DIME formula (Debt, Income, Mortgage, Education) helps you figure out how much coverage you need.

The DIME formula looks at your debts, your family’s income needs, your mortgage, and your kids’ education costs. It helps you find the right death benefit to protect your family.

For example, if you make $60,000 a year, have a $300,000 mortgage, and need $50,000 per child for college. The DIME formula suggests you need about $1,406,600 in term life insurance coverage. This amount would help keep your family financially safe.

It’s also important to think about your family’s long-term needs and any changes in your finances. This ensures your term life insurance policy covers you for the right amount of time.

Choosing the right term life insurance coverage is a smart move. It gives you peace of mind and secures your family’s financial future. By using the DIME formula and considering your unique situation, you can make a choice that fits your family’s needs and goals.

“The DIME formula is a game-changer in determining the appropriate term life insurance coverage for your family. It takes the guesswork out of this important financial decision.”

Conclusion

Term life insurance is now the top choice for families wanting financial protection and peace of mind. It’s simple, affordable, and offers flexible coverage. This makes it perfect for keeping your family safe.

Term life insurance provides a death benefit, income replacement, and debt coverage. These benefits help families stay financially stable, even when faced with unexpected loss.

Whether you’re starting a family, growing your career, or planning for retirement, term life insurance is key. It offers the coverage you need at a price you can handle. With it, you can ensure your loved ones’ future and enjoy the peace of mind that comes with knowing they’re protected.

FAQ

What is term life insurance?

Term life insurance offers coverage for a set time, like 10, 20, or 30 years. It doesn’t build cash value like permanent insurance. It’s meant to give a death benefit to your loved ones if you die during the term.

What are the benefits of term life insurance for families?

Term life insurance helps families by providing a death benefit. This can cover debts, expenses, and income, keeping your family’s lifestyle the same without you. It’s also a budget-friendly way to protect your family’s financial future.

What types of term life insurance policies are available?

There are a few types of term life insurance. Level term keeps the death benefit and premiums the same. Decreasing term lowers the death benefit over time but keeps premiums steady. Convertible term lets you switch to permanent insurance without more medical tests.

How do I determine the right amount of term life insurance coverage for my family?

Use the DIME formula to figure out coverage. It looks at debts, income, mortgages, and education costs. Think about your family’s future needs and any financial changes to pick the right policy and term.

What is the process for obtaining term life insurance?

Getting term life insurance involves the underwriting process. This might include a medical exam and health history check. You’ll also choose a beneficiary and decide on the coverage term and death benefit that suits your family.

How does term life insurance differ from permanent life insurance?

Term life insurance covers you for a set time, while permanent insurance lasts your whole life and builds cash value. Term insurance is cheaper, making it a top choice for families wanting to protect their finances.