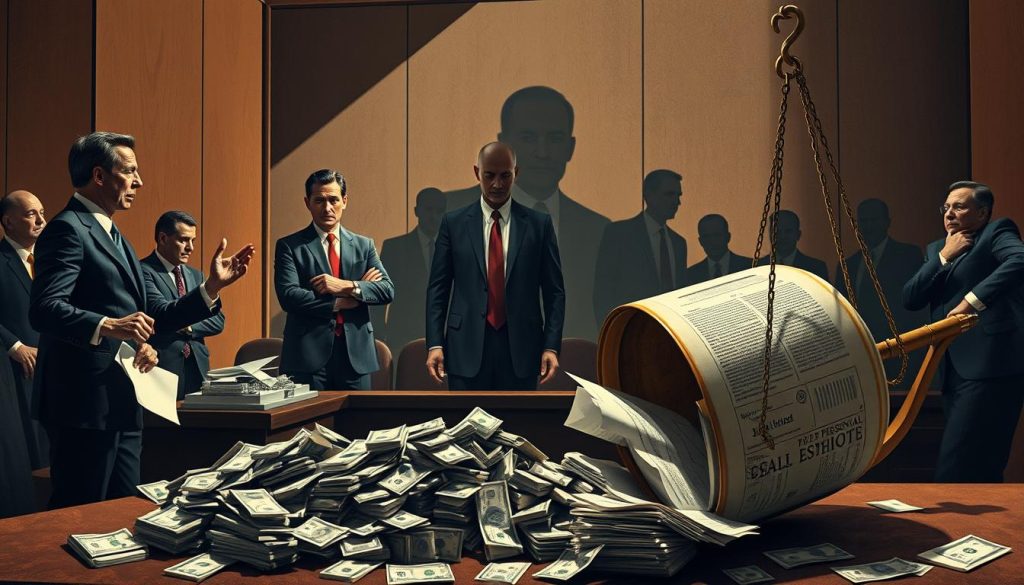

In the United States, a worrying trend is growing. Shady injury claims are costing billions of dollars each year. These scams often include staged accidents and made-up injuries. Lawyers who don’t play by the rules make a lot of money off these scams.

These claims not only hurt your wallet but also damage our legal system. They make it tough for real injury victims to get the help they need.

This article will reveal these deceitful tactics. It will also show how some lawyers act unfairly. You’ll learn how to protect yourself from these scams. Knowing how these scams work helps you stay safe and ensure justice is done.

Key Takeaways

- Fraudulent personal injury claims involving staged accidents and fake injuries are on the rise, costing billions annually.

- Unscrupulous lawyers are exploiting the legal system to make millions from these shady injury claims.

- Shady injury claims undermine the integrity of the legal system and make it harder for legitimate victims to get fair compensation.

- Recognizing the tactics used in these scams and choosing ethical legal representation are crucial steps to protect yourself.

- The financial impact of fraudulent injury claims extends to higher insurance premiums and legal fees for both consumers and the industry.

- https://finserviceshub.com/coupon-rate-understanding-and-mastering-the-essentials-for-professionals/

The Rising Trend of Fraudulent Personal Injury Claims

Fraudulent personal injury claims are a big problem, costing billions of dollars each year. These scams include staging accidents and making up or exaggerating injuries. This is known as “settlement mills.” Lawyers handling these cases push up insurance costs and legal fees across the country.

Staged Accidents and Fake Injuries

Staged auto accidents are the top insurance fraud in the U.S., starting in the 1990s. Criminal groups target cars in big cities. They often cause fake injuries like sprains and strains.

The FBI says staged accidents cost over $20 billion a year. The Coalition Against Insurance Fraud says all types of fraud cost over $80 billion annually.

Impact on Insurance Premiums and Legal Costs

Fraudulent claims raise insurance costs and legal fees. A study found 42% of soft-tissue injury claims were fake. This adds billions to the auto-injury system each year.

Many people think bad service from insurers leads to fraud. To fight this, insurance and legal groups must use data and harsh penalties. This will help protect consumers from these costs.

| Statistic | Value |

|---|---|

| Staged motor vehicle accidents cost insurers | Over $20 billion per year |

| Fraudulent insurance claims across all lines of business | Exceed $80 billion per year |

| Reported soft-tissue injury claims for nonexistent or preexistent injuries | Around 42% |

| U.S. adult consumers who believe poor insurer service can incentivize fraudulent claims | Over 50% |

“Fraudulent accidents are typically perpetrated by well-organized criminal rings.”

Tactics Used in Shady Injury Claims

The world of personal injury claims is filled with bad tactics. Some people and insurance companies use staged accidents, fake injuries, and exaggerated injuries to get money. These actions harm both the insurance companies and real victims who need justice.

Staged Accidents and Fake Injuries

Some people cause accidents or pretend to be hurt to file false claims. This is a bad practice that hurts the legal system. It makes it hard for real victims to get the help they need. Insurance companies fight back with their own strategies.

Exaggerating the Extent of Injuries

Others make their injuries seem worse than they are. They want more money from insurance. This makes the legal system cost more and makes real claims seem less believable.

Insurance companies have their own ways to deal with these shady injury claims. They watch claimants closely, ask for a lot of information, and even use private investigators. These steps might seem tough, but they help protect insurance companies from fraud.

The effects of these shady injury claims are big. They make insurance and legal costs go up for everyone. It’s a problem that affects us all. We need to stay careful and act ethically to solve it.

“Insurance companies often implement a defense strategy known as pointing out a treatment gap. This tactic involves referencing an interval where a victim stopped seeking medical treatment after an injury. Insurers may use this gap to cast doubt on the seriousness of the injury or question the claimant’s motives. However, the gap in treatment argument is challenged as it does not necessarily correlate with the level of pain or the presence of ongoing health issues.”

| Tactic | Description |

|---|---|

| Blaming the Victim | Insurance companies may try to prove that the injured party’s reactions during the accident were unreasonable, not merely different from what another driver might have done. |

| Minimizing Visible Damage | Insurers may highlight minimal vehicle damage in photographs to insinuate that the victim did not sustain significant injuries, despite the fact that injuries can occur even in cases of low visible property damage. |

| Criticizing Delayed Medical Visits | Insurance companies may argue that the lack of immediate medical attention implies that the individual was not genuinely hurt, without considering factors such as the nature of the injury and daily life demands. |

High-Profile Cases of Shady Injury Claims

The media has highlighted many shady injury claims, showing how common they are. In Texas, some personal injury lawyers have been fighting these cases for over 25 years. They mainly deal with car and truck accidents, aiming to get the most money for their clients. This can lead to false claims and higher costs for everyone.

The modified comparative negligence rule in Texas is key in these cases. It lets people get compensation even if they’re mostly to blame. This rule can be misused by dishonest lawyers, who might push for big settlements even if the claims aren’t strong.

“Insurance companies may try to push for cheaper coverage, and making quick statements to them can hurt your claim. It’s best to see a doctor after an accident, as companies might attempt to deny your claim. Getting a personal injury lawyer in Texas can help protect you from unfair tactics used by insurers.”

One big case got a $7.3 billion jury award, the biggest in 2022. Another case led to a secret settlement over $17 million, from a business lawsuit.

Some shady injury claims involve car accidents, like a wrongful death from a drunk driver. There was also a crash with a drunken driver and a famous bar, causing deaths and lawsuits.

These cases show we need better rules and checks in the legal system. We must tackle the issue of high-profile shady injury claims in Texas and elsewhere.

shady injury claims

Shady injury claims cause big problems, not just money issues. They hurt real victims, the legal system, and society. It’s a big deal.

People who fake accidents or exaggerate injuries are not just cheating insurance. They’re also making it hard for real victims to get help. Legitimate accident victims often get less money than they need. This leaves them with big medical bills and lost wages.

Those caught in shady claims face serious penalties. They could get fined or even go to jail. This is unfair to both the scammers and the real victims who need help.

Most personal injury cases are settled without going to court. But when they do, the person suing usually loses. Shady claims make it harder for real victims to get justice.

“Shady injury claims don’t just hurt insurance companies – they hurt real people who are already dealing with the aftermath of an accident. The consequences can be devastating, both financially and emotionally.”

Shady injury claims affect everyone. They hurt insurance policyholders and the public. By understanding the harm, we can protect the legal system. We can make sure those who really need help get it.

Consequences of Shady Injury Claims

Shady injury claims harm real victims and damage trust in the legal system. It makes it hard for those with legitimate claims to get the help they need. Those caught in these scams face serious legal trouble, including charges like insurance fraud and perjury.

Legal Implications and Penalties

Insurance companies might offer less money or try to take back payouts. This hurts real victims even more. The strict legal penalties, including heavy fines and jail time, show how important it is to keep the legal system honest.

By fighting these scams, we protect the rights of those who really need help. This way, we ensure fair compensation for injuries.

Malloy Law Offices, LLC, a top personal injury law firm in Maryland, says filing fraudulent claims has severe consequences. This includes possible charges for insurance fraud, with fines up to $10,000 and up to 15 years in prison. Lying under oath, or perjury, is another serious crime with big legal penalties.

The effects of shady injury claims go beyond those directly involved. Insurance companies might lower payouts or try to get back money they’ve already given out. This hurts the chances of real victims getting fair compensation. Keeping the legal system honest is key, and those who cheat undermine the support for those who really need it.

Protecting Yourself from Shady Injury Claims

To avoid falling victim to fraudulent injury claims, it’s crucial to stay vigilant and take proactive measures. Recognizing common tactics used in insurance fraud, such as staged accidents and exaggerated injuries, can help you steer clear of these scams. Choosing ethical, reputable legal representation is key when making a legitimate claim, as unscrupulous attorneys may try to exploit the system for their own financial gain.

Tips for Recognizing and Avoiding Fraud

- Document the accident thoroughly, including taking photographs and obtaining witness statements.

- Beware of early settlement offers, as these may be attempts to minimize your true compensation.

- Carefully review all forms and documents before signing, and avoid signing anything under pressure.

- Monitor your social media activity, as insurers may scrutinize your posts for evidence that contradicts your claims.

- Seek immediate medical attention and follow your treatment plan, as delays can complicate your case.

The Importance of Ethical Legal Representation

When making a legitimate injury claim, working with a reputable, ethical lawyer is essential. These professionals can help you navigate the complexities of the legal system, ensure your rights are protected, and maximize the compensation you receive. Avoid attorneys who promise unrealistic outcomes or seem more interested in their own financial gain than your well-being.

“Attorney Mark Joye recovered $2.41 million for two sisters in a personal injury case, demonstrating the importance of ethical legal representation.”

By taking these proactive steps and choosing wisely when it comes to legal counsel, you can protect yourself from becoming a target of fraudulent injury claims and ensure fair compensation for your genuine injuries.

Conclusion

The rise of shady injury claims is a big worry in the United States. Unethical lawyers and people stage accidents to cheat the insurance system. It’s important to know how these scams work to avoid them.

These scams hurt people financially and damage trust in the legal system. It makes it hard for real victims to get the help they need.

By being careful, choosing honest lawyers, and pushing for stronger laws, we can fight these scams. This helps keep the legal system fair and ensures justice for everyone.

Fighting fraud is key in the personal injury world. It keeps people safe and upholds the law’s principles.

In summary, we need to be more aware and take action against shady injury claims. Your efforts as a consumer and advocate can help keep personal injury claims honest. This way, those who really need help can get it.

FAQ

What are shady injury claims?

Shady injury claims are when people fake accidents or injuries to get money from insurance. Lawyers might do this to make more money, even if it hurts their clients.

How common are fraudulent personal injury claims?

Fraudulent claims are becoming more common in the U.S. They cost billions of dollars each year. These scams include faked accidents and injuries, known as “settlement mills.”

How do these shady claims impact the legal system and consumers?

These claims hurt consumers and make the legal system less fair. They make it hard for real victims to get what they deserve. They also increase costs for everyone.

What are some common tactics used in shady injury claims?

Scammers might stage accidents or fake injuries. They work with lawyers who care more about money than their clients. Insurance companies might offer low settlements or question the injuries.

Can you provide examples of high-profile shady injury claim cases?

In Texas, some lawyers have been scamming for over 25 years. They focus on car and truck accidents, trying to get as much money as possible. This leads to false claims and higher costs for everyone.

What are the legal consequences of being caught in a shady injury claim?

If caught, scammers face serious charges like insurance fraud and perjury. They can get heavy fines or even jail time. This hurts real victims and makes it harder for them to get fair compensation.

How can I protect myself from falling victim to shady injury claims?

To avoid scams, stay alert and know the common fraud tactics. Choose honest lawyers for your claim. Document the accident well, avoid early settlements, and work with reputable lawyers to protect yourself.