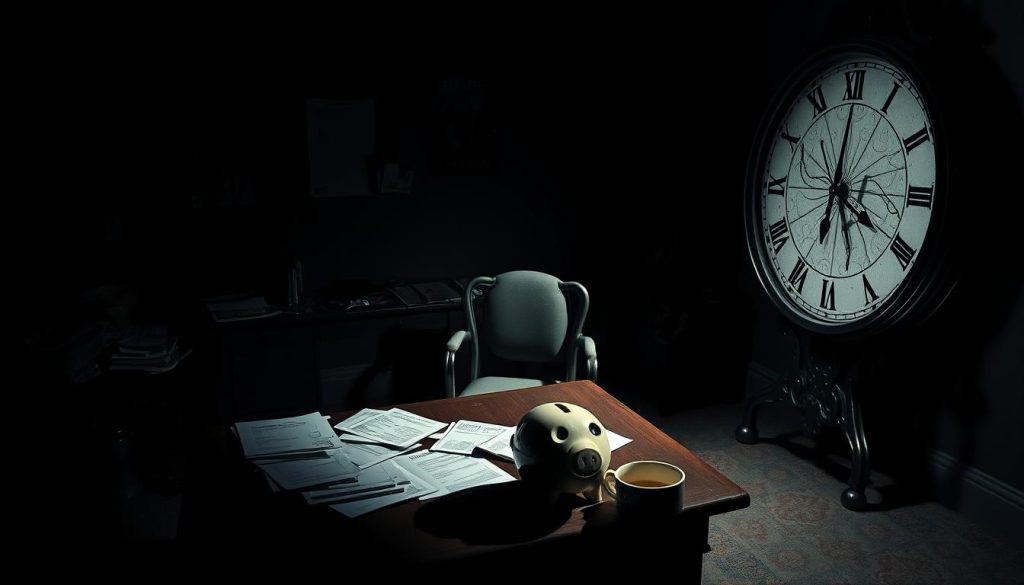

Imagine the long journey of filing a personal injury lawsuit. Then, you find out your settlement money is gone, taken by your lawyer. Sadly, this is a reality for some clients1.

While rare, personal injury lawyers sometimes scam their clients out of settlement money1. This happens when they don’t act in their clients’ best interests. They might take some of the money meant for the client, medical bills, and others who have a claim1.

Personal injury cases often use a system where the lawyer gets the money first1. This is meant to protect the client, but it can also lead to scams. Unfair lawyers might use this trust to their advantage.

Key Takeaways

- Settlement scams can occur when lawyers mishandle or misappropriate client funds during the settlement process.

- Clients should carefully review fee agreements, request detailed expense accounting, and verify payments to medical providers and subrogation interests.

- Potential legal mechanisms to challenge a fraudulent settlement include Rule 60(b) motions and independent causes of action for fraud.

- Clients should be vigilant for red flags, such as unsolicited offers from unknown “lawyers” and requests for personal information or payment.

- Reporting scams to authorities and avoiding further communication with scammers are crucial steps to protect oneself.

- https://tunekong.com/hardscaping-ideas-that-will-make-your-backyard-the-talk-of-the-neighborhood-22/

A Cautionary Tale of Settlement Gone Wrong

Settlement disputes can lead to unexpected legal issues and fraud allegations. A case involving a securities class action lawsuit2 is a prime example. Lawyers for the plaintiffs allegedly mishandled the settlement, causing a long legal battle.

The Nightmare Scenario

The opposing side claimed they found hidden facts during the settlement talks. They filed a new lawsuit, seeking big damages. They accused the lawyers of tricking the court into approving the original settlement2.

Legal Mechanisms to Challenge a Settlement

Fortunately, there are ways to challenge a settlement, like Rule 60(b) motions. These motions can reopen a judgment if there was fraud or misconduct. But, the legal fight to do this is tough, and the stakes are high2.

This story is a warning about the need for carefulness and honesty in settlements. Knowing the legal risks and staying alert to fraud can help avoid the bad outcomes of a settlement gone wrong.

Protecting Yourself from settlement scam stories

Personal injury cases often involve a lot of money. It’s key for clients to protect their rights and make sure the settlement process is clear. Start by understanding the agreement with your lawyer. Most personal injury cases are handled on a contingency basis. This means the lawyer gets a percentage of the settlement as their fee.

Understanding Contingency Fee Agreements

Contingency fee agreements usually take 33% to 40% of the settlement. It’s vital to review this agreement carefully and know how much of your settlement will go to the lawyer’s fees.3 Also, ask for detailed records of all costs and deductions. This includes court fees, expert witness costs, and medical liens. This ensures the settlement is correctly calculated and given out4.

Requesting Documentation and Verification

To protect yourself more, contact the people involved in the settlement. This includes medical providers, insurance companies, and others. Verify payments to make sure the settlement is handled openly4. This step can help spot any scams and protect your rights. It also makes sure you get the full settlement you deserve.

By knowing about contingency fees and being proactive in asking for documents, you can avoid scams. This helps keep the trust between you and your lawyer strong. Trust is crucial for a good outcome4.

settlement scam stories: The Fraudulent Life Insurance Scam

One sneaky scam is the “Fraudulent Life Insurance Scam.” Scammers pretend to be lawyers and reach out to people. They say there’s a life insurance policy worth millions that belongs to the person5. They promise to share the money if the person gives them personal details5.

But, there’s no real life insurance policy. The scammers just want your personal info or money. This is a common trick to get sensitive information or money from victims.

These scams are getting more common. The FBI says older adults lost $588 million to tech support scams in 20225. People aged 60 and older lost $3.1 billion to cyber fraud in 2022, a huge jump from the year before5.

Older adults have seen their fraud losses skyrocket. From $342 million in 2017 to $3.1 billion in 2022, it’s a huge increase5.

People aged 60 and over are often targeted by illegal call centers. They suffered 69% of the financial losses compared to other age groups5. The FBI found that nearly 18,000 Americans aged 60 and over fell victim to tech support scams in 20225.

Victims aged 60 and older lost more to tech support scams than any other age group. They lost an average of $33,000, with some losses reaching over $1 million5.

It’s important to watch out for unsolicited offers or requests for personal info. These are signs of a scam. By staying alert and reporting any suspicious activity, you can protect yourself and your loved ones from these scams.

Red Flags to Watch Out For

It’s important to be careful with settlement scams. Look out for warning signs like unsolicited offers from “lawyers” or law firms. They might say you have an unclaimed life insurance policy or other windfalls6.

Also, be cautious of requests for personal info or money. Scammers might ask for cash, gift cards, wire transfers, or cryptocurrency. They use these methods to steal your identity or money6.

Unsolicited Offers from Unknown “Lawyers”

Be careful of unsolicited calls, emails, or mail from people claiming to have settlements or unclaimed funds for you. These are often scams by impersonators pretending to be real lawyers or law firms. They want your personal and financial info6.

Requests for Personal Information or Payment

Scammers might ask for your Social Security number, bank account, or credit card info. They might also ask for upfront payments or fees, saying it’s to get your settlement or access your funds6. Never give out personal info or pay them, as it’s a scam to steal your identity or money.

Knowing these scam warning signs can help you avoid settlement scams. Always remember, if an offer seems too good to be true, it probably is7.

Steps to Take If Targeted by a Scam

If you’re targeted by a scam, act fast to protect yourself. Don’t respond to the scam or share personal info. This helps stop the scammer’s plans8. Scammers use many ways to scam people, like phone calls, texts, emails, and mail9. By not responding, you cut off their scamming path.

Report the Scam to Authorities

Next, report the scam to the right people. Use ReportFraud.ftc.gov to tell the Federal Trade Commission (FTC) about it8. Telling the FTC helps warn others and might lead to legal action against the scammers10. You might even get a reward for reporting it.

Also, contact your state’s attorney general or local police to report the scam9. If you think it’s a crime, tell the police. Also, tell consumer protection agencies to stop more scams10. But be careful when looking for help to get your money back, as some might scam you too.

By doing these things, you help keep yourself safe and fight scams for everyone10. Scams are getting worse online, so it’s key to report them to protect others.

Stay alert, don’t talk to scammers, and report the scam right away9. Talking to scammers or trying to get revenge can cost you more money and time. It’s important to stay careful and report scams quickly.

Conclusion

In this article, we’ve looked into the sad truth of settlement scams. These scams involve dishonest lawyers and fraudsters trying to make money off people. They do this by cheating in the settlement process11.

We’ve shared stories and examples to show why it’s key to be careful. It’s important to protect your rights and money. This way, you can avoid getting caught up in scams.

Knowing how to fight a settlement and understanding risks can help. It’s also important to watch out for scam signs12. Being aware, knowing your rights, and protecting your money are your best defenses.

As someone who cares about fairness, it’s vital to stay alert and report scams. We can all help by spreading the word and supporting each other. This way, we make sure the settlement process is fair and just.

By staying informed and taking action, you can keep yourself and your family safe. This is crucial to avoid the harm caused by settlement scams.

FAQ

What are some common settlement scam stories involving lawyers?

Settlement scam stories often involve lawyers not handling the settlement process well. This can lead to problems like a Rule 60(b) motion or a new fraud lawsuit. Lawyers might also scam clients by lying about fees, expenses, or settlement amounts.

How can clients protect themselves from settlement scams?

Protecting yourself means understanding your fee agreement. Also, ask for detailed expense and deduction documents. Always check with medical providers or subrogation interests to confirm payments.

Be cautious of unsolicited offers from “lawyers.” Never give out personal info or pay money in response to these offers.

What is the “Fraudulent Life Insurance Scam”?

The “Fraudulent Life Insurance Scam” tricks people by claiming they have an unclaimed life insurance policy worth millions. They ask for personal info to share the money, but the policy doesn’t exist. It’s a scam to steal your identity and money.

What are some red flags to watch out for when it comes to settlement scams?

Watch out for unsolicited offers from “lawyers” or law firms. They often claim to have unclaimed life insurance policies or other big wins. Also, be wary of requests for personal info or payment, like cash, gift cards, wire transfers, or cryptocurrency.

What should you do if you are targeted by a settlement scam?

If you’re targeted by a scam, don’t respond or share personal info. Instead, report the scam to the Federal Trade Commission (FTC) at ReportFraud.ftc.gov. This helps warn others and might aid in law enforcement actions.